With climate disasters increasing and insurers tightening their terms, finding reliable home insurance in 2025 isn’t just about the cheapest price — it’s about survival. Whether you’re buying your first policy or reviewing your current coverage, here’s how to find the best insurance providers, compare coverage, and avoid hidden traps.

Why Choosing the Right Home Insurance in 2025 Matters

- Insurer withdrawals from high-risk states (e.g., California, Florida) are leaving millions underinsured.

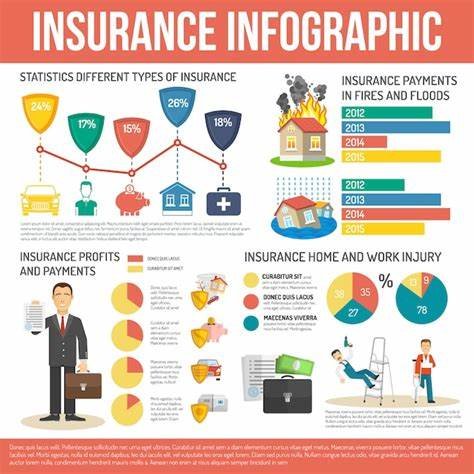

- Premiums increased 9–30% in the past 2 years (ConsumerFed.org).

- Hidden exclusions (e.g., floods, fires) leave many shocked during claims.

💡 In 2025, it’s not just about finding insurance — it’s about finding someone who won’t drop you when you need them most.

Top 5 Ways to Buy Home Insurance in 2025

1. 🏢 Traditional Insurers (State Farm, Allstate, USAA, Allianz)

- ✅ Trusted and established

- ✅ Easy to bundle with auto

- ❌ May exit your area if it’s high-risk

- ❌ Slower digital tools

2. 📱 Online Platforms (Lemonade, Hippo, Openly)

- ✅ Instant quotes

- ✅ AI-driven claims & cheaper pricing

- ❌ Heavy automation — less human support

- ❌ May use satellite data to deny claims

3. 🔄 Comparison Sites (Policygenius, Insurify, TheZebra)

- ✅ Compare quotes side-by-side

- ✅ Shows discounts for bundling

- ❌ Not all insurers listed

- ❌ Still have to verify coverage details yourself

4. 🧑💼 Independent Insurance Brokers

- ✅ Personalized advice

- ✅ Can access niche or regional insurers

- ❌ May charge a small fee

- ❌ Slower process vs. online

5. 🏠 Credit Union & Employer Plans

- ✅ Exclusive group rates

- ✅ Often include GAP or disaster riders

- ❌ Limited provider network

- ❌ Must be a member

Key Factors to Compare Before Buying

| Factor | What to Look For |

|---|---|

| Dwelling Coverage | Enough to rebuild your home at current cost |

| Personal Property | Covers furniture, electronics, clothes |

| Deductible | Higher deductible = lower premium |

| Perils Covered | Fire, theft, hail, vandalism, flooding (if added) |

| Exclusions | Earthquakes, sewer backup, mold (often extra) |

| Claim Speed | Check reviews on Trustpilot or Reddit |

Real Scenarios You Should Know

- Florida 2025: Some residents are being charged $6,000+/year and can’t find coverage at all after insurers pulled out. Citizens Insurance (state-backed) is now their only choice.

- California 2025: AI drone assessments are leading to automatic denials for houses near trees or hillsides. Some homes are labeled uninsurable (Investopedia).

Best Home Insurance Providers in 2025 (Consumer Ratings)

| Company | Best For | User Rating |

|---|---|---|

| Lemonade | Fast digital claims, young buyers | ★★★★☆ |

| State Farm | Bundling & support in low-risk zones | ★★★★★ |

| Hippo | Smart-home discount policies | ★★★★☆ |

| Allianz | Europe-wide coverage & multilingual support | ★★★★☆ |

| USAA | Military families | ★★★★★ |

Bonus: What to Watch Out For

🚩 Policies that exclude “named perils” — unless specifically listed, they’re NOT covered.

🚩 Low dwelling coverage caps that won’t rebuild your home in 2025 prices.

🚩 Claims history restrictions — too many claims = denied renewal.

Final Thoughts

Don’t fall into the trap of only comparing price. In 2025, your home insurance should be:

- Comprehensive

- Adapted to local climate risk

- From a provider who won’t cancel your policy when disaster hits

🔍 Use trusted comparison sites, consult a local agent, and review your policy at least once per year.