Denmark’s defense industry is experiencing a major upswing in business as NATO strengthens its eastern European borders with new anti-drone technology. This boom marks a significant turning point for the sector, which has been pushed into the spotlight by recent airspace violations and ongoing security threats from Russia.

The increased focus on drone defense comes as nations across the continent are scrambling to protect their critical infrastructure. The conflict in Ukraine has demonstrated the powerful role that drones play in modern warfare, and recent incidents in Western Europe have shown that this threat is no longer distant. As a result, Danish companies with expertise in counter-drone systems are seeing a rapid increase in demand for their products.

Danish Companies Benefit from Security Concerns

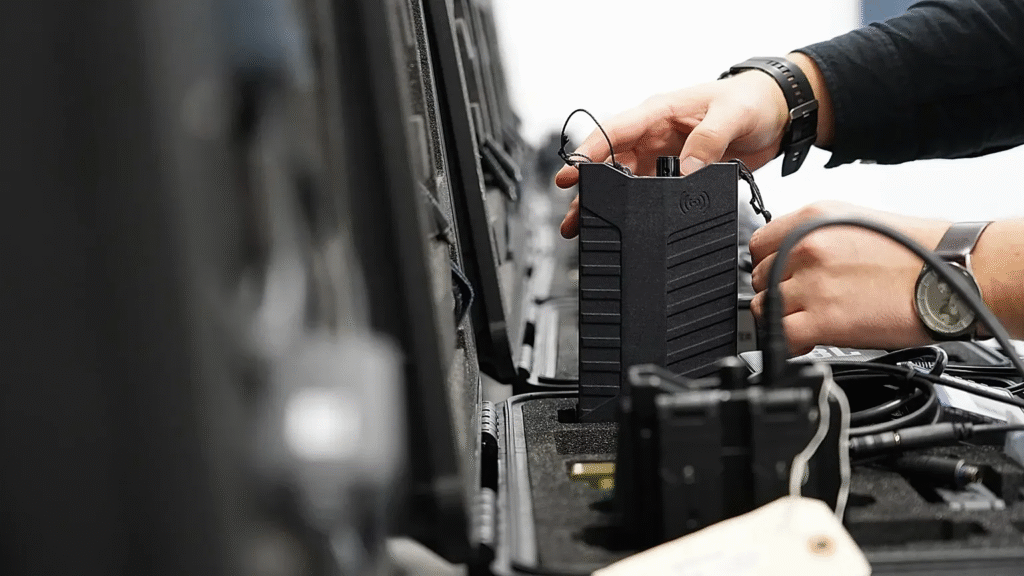

In a warehouse located in northern Denmark, employees at the company MyDefence are busy assembling anti-drone devices. These systems are being sent to two very different fronts: the battlefields of Ukraine and major European airports that have recently been dealing with mysterious drone sightings. The company’s CEO, Dan Hermansen, stated that MyDefence doubled its earnings in 2024 to about $18.7 million compared to the previous year. Since Russia’s invasion of Ukraine began nearly four years ago, the firm has supplied over 2,000 units of its “Wingman” drone detector, a device that can be worn by soldiers.

The demand for these systems skyrocketed after a series of drone incidents caused major disruptions at Copenhagen Airport on September 22, 2025. The airport was paralyzed for almost four hours. Prime Minister Mette Frederiksen described the events as “the most serious attack on Danish critical infrastructure to date.” In the days that followed, other Danish airports, including Aalborg and Billund, also experienced closures due to drone activity. These incidents prompted European leaders to agree on a plan to develop a “drone wall” along their borders to protect against future intrusions.

Hermansen explained the shift in the market. He said that people are “seeing suddenly that drone warfare is not just something that happens in Ukraine or on the eastern flank, but basically is something that we need to take care of in a hybrid warfare threat scenario.” He noted that inquiries, which used to come mostly from defense clients, are now coming from police forces and operators of critical infrastructure.

NATO Deploys New Counter-Drone Technology

In November, NATO military officials confirmed that they have deployed the American-made Merops system to several countries on the alliance’s eastern flank, including Denmark, Poland, and Romania. The Merops system is a compact, AI-powered platform that can identify and intercept hostile drones. It uses autonomous navigation, which allows it to function even when satellite communications are being jammed by the enemy. Colonel Mark McLellan of NATO Allied Land Command highlighted the system’s cost-effectiveness, stating, “It’s a lot cheaper than flying an F-35 into the air to take them down with a missile.”

This deployment is part of NATO’s Operation Eastern Sentry, which was launched on September 12 after Russian drones violated Polish airspace. NATO Secretary General Mark Rutte called Russia’s actions “reckless and unacceptable.” The Kremlin, however, has denied any responsibility for the unidentified drone flights over Europe.

Another Danish company, Weibel Scientific, which specializes in advanced Doppler radar technology, also reported a major success. In May 2025, it secured a $76 million deal, which it described as its “largest order ever.” The company’s radar systems were used at Copenhagen Airport during a recent EU summit and are now being promoted as a “key component” for any future European drone shield, according to CEO Peter Røpke.

Andreas Graae, an assistant professor at the Royal Danish Defense College, said there is a “huge drive” across Europe to quickly deploy counter-drone systems. “All countries in Europe are struggling to find the right solutions to be prepared for these new drone challenges,” he said. The European market for anti-drone technology was valued at $432.6 million in 2024 and is projected to grow to an incredible $4.08 billion by 2033, showing just how seriously the continent is taking this new threat.